Loading... Please wait...

Loading... Please wait...- Home

- Guru

-

MEGA List

- MEGA List Page

- Categories

- All Brands

- Trading Books

- AdvancedGET

- MetaStock

- MetaStock Add-ons

- MetaStock Plug-Ins

- MetaStock Utilities

- MetaTrader

- MetaTrader EA

- MetaTrader EA (Forex)

- NinjaTrader

- Statistical Analysis

- TradeStation

- TradeStation Add-Ons

- Trading Software

- Betting Exchange Software

- Mega Page - New Stuff

- Personal Development Courses

- More MEGA LIST

- More Courses_

- Books

- More Books

- Mega List #1

- Mega List #2

- Mega List #3

- Real Estate

- Course by Category #1

- Course by Category #2

- Course by Author #1

- Course by Author #2

- Course by Author #3

- Course by Author #4

- RosettaStone

- Mega Page - 0

- Mega Page - A

- Mega Page - B

- Mega Page - C

- Mega Page - D

- Mega Page - E

- Mega Page - F

- Mega Page - G

- Mega Page - H

- Mega Page - I

- Mega Page - J

- Mega Page - K

- Mega Page - L

- Mega Page - M

- Mega Page - N

- Mega Page - O

- Mega Page - P

- Mega Page - Q

- Mega Page - R

- Mega Page - S

- Mega Page - T

- Mega Page - U

- Mega Page - V

- Mega Page - W

- Mega Page - X

- Mega Page - Y

- Mega Page - Z

- MEGA CATALOG

- Search MEGA CATALOG

- Entire 3TB Hard Drive for DayTraders - For Sale $3K

- Entire 4TB Hard Drive for DayTraders – For Sale $4K

- BigBoss Hard Drive for DayTraders – For Sale $3K

- MONEY Catalog

- Some More Courses

- dvd

- estore

- libr

- shop

- store

- Portfolio

- BigBoss Hard Drive for DayTraders

- Latest Database

- FAQ

- Info

-

Market Summary

- Corona Virus Stocks

- FREE IBD WEEKLY

- FREE STOCK CHARTS

- Market.Summary

- IBD 50

- DOW 30

- NASDAQ 100

- CNBC IQ 100

- IBD Sector Leaders

- IBD Stock Spotlight

- IBD Big Cap 20

- IBD CANSLIM Select

- IBD Global Leaders

- IBD IPO Leaders

- IBD New Highs

- IBD Rising Profit Estimates

- IBD Relative Strength At New High

- IBD Stocks That Big Mutual Funds Are Buying

- IBD Weekly Review

- IBD Stocks On The Move Up

- IBD Stocks On The Move Down

- Zacks Rank #1 Strong Buys

- Zacks Rank #5 Strong Sells

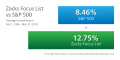

- Zacks Focus

- SPDR XLB Basic Materials

- SPDR XLC Communication Services

- SPDR XLE Energy

- SPDR XLF Financial

- SPDR XLI Industrials

- SPDR XLK Technology

- SPDR XLP Consumer Staples

- SPDR XLRE Real Estate

- SPDR XLU Utilities

- SPDR XLV Healthcare

- SPDR XLY Consumer Discretionary Goods

- Direxion Leveraged & Inverse ETFs

- IBD Innovator ETFs

- Technology ETFs

- Select Sector SPDR ETFs

- MARKET_SUMMARY

- 52 Week High Stocks

- 52 Week Low Stocks

- AGFiQ ETFs

- Airline Stocks

- Barron Stock Picks

- Bond ETFs

- IBD CANSLIM Grand Slam

- Casinos Gaming Stocks

- Commodity ETFs

- Equity ETFs

- ETF Investor

- First Trust ETFs

- Four Horsemen

- Home Run Investor

- IBD Breakout Opportunities ETF

- IBD Breakout Stocks

- IBD Dividend Leaders

- IBD ETF Leaders

- IBD Income Investor

- IBD REIT Leaders

- IBD Tech Leaders

- IBD Utility Leaders

- Income Investor

- International ETFs

- Invesco ETFs

- iShares ETFs

- JPMorgan ETFs

- Large Cap ETFs

- Marijuana Stocks

- Mid Cap ETFs

- ProShares ETFs

- REITs

- Sector ETFs

- Small Cap ETFs

- SPDR State Street Global Advisors ETFs

- Stocks at All Time Highs

- Stocks at All Time Lows

- Stocks Under $10

- Top 80 Technology ETFs

- Travel Hotel Stocks

- US Small Cap ETFs

- USAA ETFs

- Value Investor

- Warren Buffett Berkshire Hathaway Portfolio

- WisdomTree ETFs

- Zacks Top 10 Stocks

- Market Summary 2

- Publicly Traded Advertising and Marketing Stocks

- Publicly Traded Aerospace & Defense Stocks

- Publicly Traded Agricultural Stocks

- Publicly Traded Aviation Stocks

- Publicly Traded Biotech Stocks

- Publicly Traded Building Product and Materials Stocks

- Publicly Traded Business Service Stocks

- Publicly Traded Chemical Stocks

- Publicly Traded Clean Energy Stocks

- Publicly Traded Clothing and Footwear Stocks

- Publicly Traded Construction Stocks

- Publicly Traded Consumer Goods Stocks

- Publicly Traded Consumer Service Stocks

- Publicly Traded Cyber Security Stocks

- Publicly Traded Education and Training Stocks

- Publicly Traded Energy Stocks

- Publicly Traded Entertainment Stocks

- Publicly Traded Environmental Services Stocks

- Publicly Traded Financial Sector Stocks

- Publicly Traded Food and Beverage Stocks

- Publicly Traded Game and Hobby Stocks

- Publicly Traded Health and Fitness Stocks

- Publicly Traded Healthcare Facilities Stocks

- Publicly Traded Healthcare Stocks

- Publicly Traded Home Furnishing and Improvement Stocks

- Publicly Traded Industrial Stocks

- Publicly Traded Insurance Stocks

- Publicly Traded Internet Stocks

- Publicly Traded Materials Sector Stocks

- Publicly Traded Media Stocks

- Publicly Traded Medical Device and Equipment Stocks

- Publicly Traded Metal and Mining Stocks

- Publicly Traded Motor Vehicle Stocks

- Publicly Traded Multi Sector Stocks

- Publicly Traded Office Equipment and Supply Stocks

- Publicly Traded Pharmaceutical Stocks

- Publicly Traded Real Estate Stocks

- Publicly Traded Regional Major and Foreign Bank Stocks

- Publicly Traded REITs Stocks

- Publicly Traded Restaurants Stocks

- Publicly Traded Retail Stocks

- Publicly Traded Semiconductor Stocks

- Publicly Traded Shipping Stocks

- Publicly Traded Sin Stocks

- Publicly Traded Software Stocks

- Publicly Traded Sports Stocks

- Publicly Traded Technology Stocks

- Publicly Traded Telecommunications and Communications Stocks

- Publicly Traded Transportation Stocks

- Publicly Traded Travel and Tourism Stocks

- Publicly Traded Utilities Stocks

- SPDR Corporate & Government Bonds ETFs

- SPDR International ETFs

- Top 97 International Equity ETFs

- Portfolios

- Stock Charts

- MEGA VAULT

- Stream Movies

Categories

- Home

- Candlesticks

- Steve Nison - Candlestick Secrets For Profiting In Options

Product Description

Candlestick Framework

Review of all the essentials you need to know about candlesticks so you are up to speed when Steve refers to them in the option strategy sections. In this module, the focus is the power of single candlestick lines.

- Why Nison candlesticks and options are the perfect fit

- The Trading Triad™

- Doji essentials

- Candles to set protective stops

- The Hammer

- The Shooting Star

- The High Wave Candlestick

- The Bullish Engulfing Pattern

- The Bearish Engulfing Pattern

- Rising and falling windows

- Change of polarity

- Snap and crack

- Falling off the roof

- Adapting to new market conditions

- Chart challenges

Options Framework

If you are brand new to options this will get you quickly up to speed on the essentials. If you are an experienced option trader it is a great review and. PLUS, experienced options traders will pick up new approaches or ideas in this section.

- The benefits of options

- Review of option essentials

- Buying In, At and Out of the Money Strikes

- Implied Volatility

- Out of the Money and In The Money – Pros/Cons of each

- Time value decay

- Advantages and disadvantages of short term expirations

- Advantages and disadvantages of longer term expirations

- The Greeks

- Bull spread – definitions, best strikes, when to use, cautions

- Bear spreads – definitions, best strikes, when to use, cautions

- When to buy options outright instead of spreads

- Methods to gauge confidence levels

- Long outright option strategies for when you have high confidence

- Long outright option strategies for when you have lower confidence

Finding the High Probability Option Strategies Using Nison Candlestick Strategies

- Building on what you learned in the prior sessions, Steve now delves into specific option trading strategies using Nison candlesticks.

- Importance of trend compared to implied volatility

- Volatility skew

- When to enter, exit and the best strike price to use for long calls

- When to enter, exit and the best strike prices to use for long puts

- When to enter, exit and best strike prices to use for bull debit spreads

- When to enter, exit and best strike prices to use for bull credit spreads

- When to enter, exit and best strike prices to use for bear debit spreads

- When to enter, exit and best strike prices to use for bear credit spreads

- Discover by using the Nison candlestick insights when to do an outright and when to do a spread

- Advantages and cautions of bull debit and credit spreads

- Advantages and cautions of bear debit and credit spreads

- Using the brand new “Nison Candlestick Confidence Filtering Strategy ” to set up the perfect option trades

- Secrets of Nison candlesticks for market direction and timing option trades

- Using the Trading Triad Success System™ to help overcome option trading challenges

- Why bearish candle signals must be traded differently in option markets

- Nison Candlesticks for day trading options

- Nison candlesticks for portfolio protection

- When to use protective puts instead of covered calls

- Nison candlestick timing strategies for covered calls

- Nison candlestick timing strategies for protective puts

- Using “Nison Candlestick Confirmation” for portfolio protection strategies

- How to let your portfolio profits increase by knowing exactly when to exit a covered call or protective put

- Chart Challenges and “Read Steve’s Mind”

- SPECIAL BONUS SESSION: Using the Nison Candle Scanner software to quickly find a watch list of markets… plus our secret “Bouncing Ball” trading strategy

Merging Nison Candlesticks and Western indicators for High Success Option Strategies

- Steve will reveal exactly how merging Nison candlesticks with Western indicators will be your one-two punch for option success.

- Using the 4 New Nison Candlestick Confirmation Option Strategies™ for:

- Long calls

- Bull call spreads

- Bull put spreads

- Long puts

- Bear put spreads

- Bear call spreads

- The one time you must use a credit spread instead of debit spread

- The two simple questions you need to ask before you do any option trade

- Improving success by setting up trades in the direction of major trend

- Price target strategies for:

- Long calls

- Bull debit spreads

- Bull credit spreads

- Long puts

- Bear debit spreads

- Bear credit spreads

- Option strategies using box ranges and Nison candlesticks

- Option strategies using Bollinger Bands and Nison Candlesticks

- The secret Nison Symmetry™ Strategy to forecast BOTH time and target

- Option strategies using The Change of Polarity technique

- Option strategies using The Falling Off the Roof technique

- Option strategies using breakouts

- Chart Challenges and “Read Steve’s Mind”

Trade Management Option Strategies for Improved Market Timing and Decreased Risk

- A Japanese proverb states, “His potential is that of the fully drawn bow–his timing the release of the trigger” A correct understanding of Trade Management will tell you when, and when not to pull the trigger on an options trade:

- Using Risk/Reward analysis to determine the correct option strategy

- How options let you be more flexible with protective stops to help avoid being stopped out and then having the market go in your direction

- Monitoring and adjusting open option positions

- Using the “Market Chameleon” strategy to know when to leg into a bull spread

- Using the “Market Chameleon” strategy to know when to leg into a bear spread

- Rolling up on long calls to let profits ride during rallies

- Rolling down on long puts to let profits ride during selloffs

- Legging into bull and bear spreads to lock in profits

- Low cost way to reverse positions by legging out of spreads

- Using protective stops to protect trading capital

- Using time stops to protect trading capital

- Using the “Crack and Snap” strategy to leg out of a bull spread

- Using the “Crack and Snap” strategy to leg out of a bear spread

- Using Nison candlesticks to know when to exit open option trades

- Chart Challenges and “Read Steve’s Mind”